In the ever-evolving digital landscape, where cybercrime looms like a persistent shadow, protecting your business from costly online threats has become paramount. While cyber insurance plays a crucial role in safeguarding your organization, there’s another layer of coverage that often goes overlooked: third-party cyber insurance. It’s like having a secret weapon in your digital arsenal, providing you with an extra line of defense against the financial repercussions of cyber events that can not only harm your own systems but also affect your clients, partners, and vendors. By delving into the world of third-party cyber insurance, you’ll discover how it can empower your business to navigate the treacherous waters of cyberspace with increased confidence and resilience.

What is Covered by Third-Party Cyber Insurance?

Third-party cyber insurance policies can provide coverage for various types of liability that a business may face as a result of a cyberattack or data breach. Here are the key areas of coverage:

First-Party vs. Third-Party Cyber Insurance

- First-party cyber insurance covers the costs incurred by the business itself as a result of a cyberattack, such as data recovery, business interruption, and reputational damage.

- Third-party cyber insurance covers the costs of claims made against the business by third parties who have been harmed by the cyberattack, such as customers, vendors, and regulatory agencies.

Legal Liability Coverage

- Defense costs: This coverage pays for the legal fees and expenses incurred in defending against third-party lawsuits.

- Judgments and settlements: This coverage pays for any damages or settlements awarded to third parties as a result of a successful lawsuit.

- Regulatory penalties: This coverage pays for fines and penalties imposed by regulatory agencies for non-compliance with data protection laws and regulations.

Data Breach Response Coverage

- Forensic investigation: This coverage pays for the costs of investigating the data breach and determining its scope and impact.

- Notification expenses: This coverage pays for the costs of notifying affected individuals and regulatory agencies about the data breach.

- Credit monitoring: This coverage pays for the costs of providing credit monitoring services to individuals whose personal information has been compromised.

Cyber Extortion Coverage

- Ransomware payments: This coverage pays for the costs of paying a ransom to cybercriminals in order to regain access to encrypted data or systems.

- Business interruption: This coverage pays for the lost income and expenses incurred as a result of a cyber extortion attack.

- Crisis management: This coverage pays for the costs of hiring a crisis management firm to help the business respond to and mitigate the impact of a cyber extortion attack.

Privacy Liability Coverage

- Breach of privacy: This coverage pays for the costs of defending against and settling lawsuits alleging violations of privacy laws, such as the unauthorized disclosure of personal information.

- Defamation and libel: This coverage pays for the costs of defending against and settling lawsuits alleging defamation or libel in connection with a cyberattack or data breach.

- Invasion of privacy: This coverage pays for the costs of defending against and settling lawsuits alleging the unauthorized intrusion into the personal lives of individuals through electronic means.

What Third-Party Cyber Insurance Covers

1. Data Breaches

Third-party cyber insurance covers the costs associated with a data breach, including expenses for investigating the breach, notifying affected individuals, and mitigating any damages.

2. Privacy Violations

The insurance policy provides coverage for violations of privacy laws, such as the Health Insurance Portability and Accountability Act (HIPAA) or the European Union’s General Data Protection Regulation (GDPR), which protect the personal information of individuals.

3. Cyberbullying and Extortion

In the case of cyberbullying or extortion attempts, third-party cyber insurance covers legal expenses, settlement costs, and reputational damage control.

4. Business Interruption

If a cyberattack disrupts your business operations, the insurance can cover lost revenue, extra expenses, and other financial losses.

5. Legal Liability

The policy covers legal costs and judgments in the event of lawsuits filed by third parties who have been harmed by a data breach or other cyber incident.

6. Reputation Damage

Third-party cyber insurance protects against reputational damage caused by a cyberattack, including costs for public relations consulting, crisis management, and social media monitoring.

7. Regulatory Investigations

In the event of a cyber incident, the insurance can cover costs associated with regulatory investigations and fines.

8. Vendor Liability

If a third-party vendor is responsible for a data breach that affects your business, the insurance can provide coverage for legal expenses and settlement costs.

9. Cybercrime

The policy covers financial losses resulting from cybercrimes such as phishing scams, ransomware attacks, and malware infections.

10. Social Engineering

Social engineering attacks, where attackers manipulate individuals to gain access to sensitive information or systems, are also covered by third-party cyber insurance.

Benefits of Third Party Cyber Insurance

1. Financial Protection from Litigation Costs

Cyberattacks can lead to expensive lawsuits from victims seeking compensation for damages incurred. Third party cyber insurance provides financial coverage for legal defense costs, settlements, and judgments, mitigating the financial burden on businesses.

2. Coverage for Privacy Breaches

Privacy breaches, such as data breaches exposing customer information, can damage a company’s reputation and lead to legal liability. Third party cyber insurance covers costs associated with investigations, notifications, and credit monitoring for affected individuals.

3. Business Interruption Coverage

Cyberattacks can disrupt business operations,導致停機 and lost revenue. Third party cyber insurance provides coverage for income lost due to business interruption, allowing businesses to recover and continue operations.

4. Vendor Coverage

Businesses rely on various vendors for essential services. Third party cyber insurance extends coverage to vendors, such as cloud providers or software vendors, in case they experience a cyberattack that affects the business. This ensures continuity of operations and minimizes the impact of third-party vulnerabilities.

5. Breach Response Services

Many third party cyber insurance policies offer breach response services, such as incident management assistance, forensic investigations, and public relations support. These services help businesses navigate the complexities of cyber incidents and minimize reputational damage.

Thanks for Reading!

Well friends, that wraps up our chat about third-party cyber insurance. I hope you found it helpful! If you have any other questions or need further guidance, don’t hesitate to reach out. We’re always happy to help. Remember to come back soon for more informative articles and industry insights. See you next time!

Checkout These Recommendations:

- Corporate Cyber Insurance: A Shield against Digital… In this age of rampant cyberattacks, businesses of all sizes are facing increasing threats to their digital infrastructure. With the rise of remote work and the proliferation of connected devices,…

- Protecting Your Business with SMB Cyber Insurance: A… In today's digital landscape, where even the smallest businesses rely heavily on technology, cyber threats pose a significant risk. For small and medium-sized businesses (SMBs), the consequences of a cyber…

- Cybersecurity Insurance Quotes: Protect Your… In today's digital landscape, protecting your business and data from cyberattacks has become paramount. As the frequency and sophistication of cyber threats continue to rise, it's essential to consider securing…

- Cyber Insurance for Financial Institutions:… In the ever-evolving digital landscape, financial institutions are facing an unprecedented threat from cybercriminals. With the rise of sophisticated hacking techniques and the proliferation of sensitive financial data, protecting against…

- Cybersecurity Insurance: Protecting Your Business in… The digital age has brought with it a host of new risks, and cyber security is one of the most pressing. Businesses of all sizes are vulnerable to cyber attacks,…

- Cyber Liability Insurance: A Safety Net for… In today's digital era, technology companies navigate a complex landscape where cyber threats lurk around every corner. From data breaches and ransomware attacks to phishing scams and hacking, the risks…

- Cyber Liability Insurance: Essential Protection for… In today's digital world, where our lives and businesses are increasingly intertwined with the internet, protecting ourselves against cyber threats has become an essential concern. From data breaches and malware…

- The Rising Cost of Cybersecurity Insurance: A… In this modern age of digital domination, where our precious data dances through the labyrinthine realms of cyberspace, the fear of cyberattacks looms like a formidable shadow. Businesses and individuals…

- Cybersecurity Insurance: Protecting Your Business… In today's digitally interconnected world, where every click and keystroke leaves a trail, it's no wonder that cyber threats are on the rise. From ransomware attacks that can cripple businesses…

- Allstate Cyber Insurance: Protect Your Business from… In today's digital world, where we're constantly connected and sharing personal information online, it's more important than ever to protect ourselves from the ever-present threat of cybercrime. One way to…

- Understanding Cyber Liability Insurance: Definition… In the digital age, businesses and individuals rely heavily on technology, making them more susceptible to cyber threats. From data breaches to ransomware attacks, cyber incidents can have devastating consequences,…

- Cybersecurity Insurance: A Growing Market for… In today's increasingly digital world, protecting our online assets has become more crucial than ever. Cybercriminals are constantly lurking in the shadows, ready to exploit any weaknesses in our digital…

- Cyber Risk Insurance Companies: Protecting Your… In today's digital landscape, where cyberattacks have become as ubiquitous as the internet, protecting your business from online threats is paramount. That's where cyber risk insurance companies step into the…

- Cyber Security Insurance: A Necessity for Law Firms… Buckle up, legal eagles! In a digital realm where data breaches lurk like shadows, it's time to amp up your cybersecurity defense. Cyber insurance for law firms is no longer…

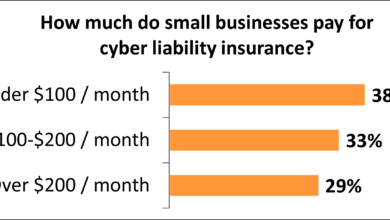

- Cyber Liability Insurance Costs: A Breakdown In today's high-tech realm, protecting against cyber threats is crucial for businesses of all sizes. Cyber liability insurance offers a safety net, safeguarding companies from costly consequences of data breaches,…

- Navigating the Cyber Risk Landscape: The Role of… In today's ever-evolving digital landscape, protecting your organization from cyber threats is paramount. Cyber security insurance brokers have emerged as invaluable partners in the fight against these malicious attacks. Acting…

- Cybersecurity Imperative for Insurance Companies in… In an era defined by rapid digital advancements, insurance companies are facing an unprecedented frontier: the sprawling virtual realm of cybersecurity. As technology entwines itself deeper into every aspect of…

- Arctic Wolf Cyber Insurance: Protecting Your… In the ever-evolving digital landscape, the threat of cyberattacks looms large, leaving businesses and organizations vulnerable. Arctic Wolf Cyber Insurance provides a safety net, offering comprehensive protection against the financial…

- Munich Re Cyber Insurance: Shielding Businesses from… In today's digital age, where cyber threats lurk around every click and keystroke, having a robust safety net to protect your business is paramount. Enter Munich Re Cyber Insurance, a…

- Cyber Resilience Insurance: A Lifeline in the Digital Age In a world increasingly reliant on digital technology, the threats posed by cyberattacks are more prevalent than ever before. Businesses of all sizes and industries could become victims of data…

- Protect Your Assets: A Comprehensive Guide to Cyber… In today's digital landscape, where online activities and threats lurk around every corner, having robust protection for your company's cyberspace is paramount. Cyber liability insurance is a lifeline in this…

- Great American Cyber Insurance: Comprehensive… In the ever-evolving digital landscape, protecting your business from the threats lurking in the cyber realm is paramount. Great American Cyber Insurance steps up to the plate with a tailored…

- Chubb Cyber Security Insurance: Protect Your… In today's increasingly digital world, safeguarding your business from cyber threats is no longer an option but a paramount necessity. Chubb Cyber Security Insurance offers a comprehensive suite of coverage…

- Cyber Threat Insurance: A Vital Shield in the Digital Age In the ever-evolving digital landscape, where cyberattacks are becoming increasingly sophisticated and pervasive, businesses of all sizes are facing a growing need to protect themselves from the potentially devastating financial…

- Cyber Privacy Insurance: Safeguarding Your Digital… In today's digital age, our personal information is constantly at risk. From data breaches to identity theft, there are countless ways our privacy can be compromised. That's why it's more…

- Protect Your Digital Assets: The Importance of Cyber… In today's increasingly digital world, our valuable data and systems are constantly at risk from cyberattacks. From malicious malware to phishing scams, these threats can cause significant financial losses and…

- Cyber Liability Insurance: Protecting Your Business… In today's digital age, protecting your business from cyber threats is paramount. With increasing reliance on the internet and vast amounts of sensitive data being stored online, the risk of…

- Cyber Liability Insurance: Understanding Costs and Coverage In today's digital landscape, where data breaches and cyberattacks are becoming increasingly common, businesses face a growing need to protect themselves from the financial consequences of these threats. Cyber liability…

- Navigating the Cybersecurity Insurance Market: Top… In today's digital age, where cyber threats lurk around every corner, protecting your business from malicious attacks is a paramount concern. Cyber Security Insurance Providers step into this crucial role,…

- GEICO Cyber Insurance: Protection for Your Digital Life Hey there, folks! Have you ever had that sinking feeling when you realize your precious personal information has been compromised online? It's like a virtual nightmare, right? But fear not,…